I am already so weary of this so-called "class warfare" thing going on in our political discourse.

For the purpose of what I have to say on the matter, let's remove from the table any discussion of tax rates, what's fair vs. not fair, whether the rich should pay a higher percentage than those at the poverty level, etc.

OK, let me say one thing and THEN we'll take it off the table. The debate at least has some merit. I understand why some people with a rather narrow view might think it's so unfair that someone making $5 million a year is taxed at a higher rate than a family of four trying to get by on $25,000 a year...or less. If you are in the camp that believes everyone, regardless of income, should pay a flat tax of 10% because it's "fair", I think you are full of shit. As soon as a tax rate starts to take basic necessities of life away, then it's too high and unfair.

Someone working minimum wage, or two minimum wage jobs, and trying to support a child while being taxed is going to be forced to do without something basic, and adequate food will quite likely be one of the many sacrifices. Anyone making $100,000 probably isn't going to need to skip a meal due to finances even at a higher tax rate. Depending on where they live, the yacht might have to wait, but so be it.

Now let's just focus on income rather than tax rates. What do you suppose would be the reaction if the top 3% of our school teachers -- the best of the best -- were being paid $300,000 or $400,000 a year? There would be an uproar the likes of which we'd never heard coming from the right, center, and probably even from some on the left. What about the best of the police? (The ones who aren't out using their clubs and teargas to suppress people exercising freedom of speech.) And what about nurses and firefighters?

I can't think of a single ordinary job description which doesn't have some kind of salary range which everyone accepts without question. We all know the kid at the Pizza Hut probably isn't hauling in 70-grand a year no matter how hard he or she might be working, or how great they are at what they do.

I consider myself to be extremely fortunate with my career in advertising (despite my current unemployment). I've always known the positions I've held in the industry were critical for the success of the organization and the client base. If I failed to get creative materials to a media outlet in a timely manner, the advertising campaign could be jeopardized. Having been a media buyer for 12 years, I know that if I don't secure the time slots on desired networks, the commercials will not be seen. And not to strictly toot my own horn, I also know the commercials themselves have to be compelling enough to get a certain number of average television viewers to pick up the phone or go to the website and order the can't-live-life-without-it widget for $19.95 plus $7.95 shipping. If they don't, then it doesn't even matter how well I do my part. No money coming in means I don't have a job, even if I'm the best damn media buyer on the planet. So thank you creative directors and producers everywhere!

I have worked as hard as anyone in the industry and have played my part in generating tens of millions of dollars in revenue for agencies and clients. A lot of profits have been made as a result of my efforts.

All that being said, my compensation has always been salaried with a small percentage of my salary coming as a bonus some years. And by small percentage, I'm talking 10% maximum and as an overall average through the years more like 3%-5%. Regardless of how much revenue I generate or how much profit a client might make as a result of my efforts, I know as a media buyer that I will never make $500,000 a year, nor should I.

I have made as little as $43,000 and as much as $88,000. Those salaries, particularly the latter, would be seen by many people as wonderful and I never took it for granted. The advertising industry is not what I would call stable work and that $88,000 salary lasted less than a year and was followed by 5 months of unemployment and then by a job paying half as much! Worth noting also is that the highest salary I earned did not come with any benefits whatsoever. It was freelance work. No medical, no dental, no paid vacation.

Perhaps because of my experience, and a constant awareness that I've been doing OK because somebody...a LOT of people who might not be doing as well as I am have been ordering a bunch of stuff they see on TV and therefore I knew where my money was coming from ultimately. I, along with everyone else in these organizations, are making a living thanks to people buying mops, steam-cleaners, hideous knives which are guaranteed to send x number of people to emergency rooms, food dehydrators, hand blenders, appliances which catch on fire after 3 uses, robots to vacuum your floor, 935 different devices to make you thin or have awesome abs, ladders, woks, drills, paint appliers, paint removers, pasta makers, chicken rotisseries, cat piss odor suppressors, zit removers, teeth whiteners, breath fresheners, memory enhancers, spray-on hair for bald spots, "gold" colored coins being marketed as "investments" that have a fucking fleck of real gold in them worth about 80 cents, and wealth-building methods which, if successful, God-forbid you should pay more in taxes! And let's not forget pills that make your dick hard so you can always be ready to fuck on a moment's notice. (Make sure you have health insurance because if that boner lasts more than four hours you need to see a doctor right away!)

Yep, I've always known who butters my bread.

I also take it to the next level. I look at corporate profits. Let's take the Waltons for instance. No, not John, Olivia, John-Boy, Mary Ellen and the rest of them. I'm referring to the other, slightly more fortunate Walton family....the ones worth about $93 billion, give or take a little, thanks to a thriving chain of retail outlets selling lots and lots of people even more cheap shit than I can fathom.

I am trying to imagine how anyone makes money that isn't somehow, directly or indirectly, made possible by consumers like us going out and buying stuff.

On a side note, I do appreciate it when someone like Alice Walton comes along and decides to give a little something back

to the local community, I don't see that happening nearly enough, and

she still could have, and probably would have, if she'd paid 5% more in

tax on those billions. But hey, museum admission is FREE thanks to Wal-Mart!

God bless them.

When I was a child, I remember being able to put 5 cents in a vending machine and getting a cold Coca-Cola in a bottle. A gallon of gasoline was less than 50 cents and some dude would come out and fill your tank, check your oil, and clean your windows! With a smile on his face (sometimes). Back in those days, if you mentioned that you'd bought something made in China you'd probably have been branded a red communist on the spot.

Thanks to corporate greed, it's hard to find an American flag decal for your Hummer that isn't made in China. And this is where I start to come unhinged.

We pay the same or more for the same products as we did a few years ago when those products were made in North America or even Europe. Manufacturing jobs vanished as corporations hauled their production to countries where wages are pennies compared to dollars. Corporations are doing great as a result of these and other tactics aimed at maximizing income and pleasing their shareholders.

As an example I love to use Ray Irani, CEO of Occidental Petroleum, who in 2010 had a salary of $1,191,667. Not bad. I'm not sure there's a man or woman on the planet who is actually worth that kind of money, but hey. I'm sure he has a family to feed just like most other working Americans. And I'll bet his mortgage payment is a bitch. So I don't begrudge him for it. Really, I don't. I'm sure he hates long meetings and conference calls as much as the rest of us do.

However, I do know that salaries like that are made possible, and only made possible, because people like us are buying shit or services.

But here's the real kicker. Mr. Irani can certainly survive quite well on that salary. He might have to make some conservative adjustments here and there. He might have to save up for 7 or 8 years before he can afford to buy his yacht. I have no idea what his living arrangements are but it might be rough if he wants a 10,000 square foot home in Los Angeles, even in Compton (if there is such a thing as a home that large in Compton). Maybe he'd have to settle for 4,000 square feet. Hey, life's tough and we have to manage it.

But he doesn't just make $1,191,667. Mr. Irani also raked in a little extra as a bonus in 2010: $32,975,000 to be precise.

OK, I'll be totally honest here. I just lost any fucking compassion I might have had over his cost of housing dilemma. Or how long he might have to wait before he gets his goddamn yacht. Before all of you start screaming "but...but...what if, like you, he had a rough year in 2009 and only made half of what he was making in 2010!", let me finish. I'm not done yet.

Also in 2010, Mr. Irani got some stock and options to, you know, help pad his condition a little more just in case he might have been irresponsible in some way and squandered $10 or $20 million after too much rum punch at a black tie gala. That bumped him up another $40,250,000. But maybe we shouldn't even count that... it's all just on paper for now.

Total compensation package for 2010: $76,107,010.

If my 2010 bonus alone, as a percentage of salary had been that much, I would have been given an extra $1,660,279.30 for my superb contributions to the advertising agency. I would have told them they were out of their minds (after waiting to be sure the check was going to clear the bank). And then I would have promptly resigned because (a) that's just insane business behavior, (b) it seems unsustainable and would put me under incredible pressure to live up to that value, and (c) I could easily retire very comfortably on that sum.

Now you know why I love using Mr. Irani as my example. He's not even the top dog in the CEO pyramid for 2010. That honor goes to the head of Viacom who edged him out by about $8 million. That's OK though because they did OK too based on 2nd quarter financial reports just released on May 3rd. Believe me, that 8:30 AM conference call on Friday was probably worth attending!

In light of all this I totally understand where Mitt Romney is coming from. These are his people and his world. And in their eyes it's just not fair that a majority of us want them to pay a higher tax rate than a Mr. and Mrs. Gonzalez trying to make ends meet by pressing out tortillas in Tyler, Texas all day so they can afford to fill up their tanks at the Exxon station on the way to Wal-Mart or Kroger to buy shit for their kids to eat for dinner.

There's just a couple of things I do not understand. At what point does executive compensation become immoral? How much is too much? Do we draw the line at $100 million a year? And why would anyone in their right mind want or expect to be compensated that much in one year anyway? It's almost more money than any human could possibly spend unless they want to go the extra mile and do something crazy like...I dunno... what? Buy an election? Control the entire political process? You tell me.

One of the joys in life in setting realistic financial goals and reaching them; $70 or $80 million a year kinda takes the fun out of that aspect. Maybe I'm just a little too sensitive because if I was raking in $2 million a year I'd be running a kick-ass food bank or something instead of trying to figure out where my next $60 million was coming from and whether all the liberal socialists were going to jack up my tax rate because of some podunky thing like our educational system falling apart, roads and bridges needing repair, water systems in dire need of updating, and preparing ourselves to be technological stand-outs in the fucking 21st century which, by the way, is already 12% behind us while we squabble over marriage equality and the evils of reefer, both of which will surely, sooner or later, rip apart our moral fiber and destroy our civilization.

But what truly blows my mind to shreds are not the Mitt Romneys of the world, or the people making so much money it can't possibly be spent on any personal "needs" without appearing to be a complete and total self-absorbed prick with horrific taste in chandeliers. If a family of 8 could live comfortably in your master bath and walk-in closet, you might need to take a step back and self-evaluate.

What I'm throwing my hands in the air about are the people like you and I, who are making $25k a year, $50k a year, $75k a year and are actually having to feed and educate their children, and keep them clothed, and look after their health care needs, make sure the mortgage payment is sent in on time, try to sock a little back for unexpected emergencies, and plan for retirement, all of which are generating more wealth for those corporations who control this system, while these very struggling people simultaneously weep these ridiculous tears that it would be so unfair to tax the rich at a higher rate than anyone else, and because those of us who are actually blessed with a functioning conscience, we must be Marxists and anti-American. (Or French.)

I am not a Christian but all of this is enough to make me wish Jesus would come back right this instant and yank so many of his followers' heads out of their asses. But I have a hunch we're just going to have to let this play out, and the ride is not going to be one of joy.

Thanks for listening, and Vive la France!

Showing posts with label Haves vs. Have Nots. Show all posts

Showing posts with label Haves vs. Have Nots. Show all posts

Sunday, May 06, 2012

Saturday, October 01, 2011

An Inconvenient Solution

I figured out long ago how to combat this shit.

I haven't flown on a plane in probably eight years. And yes, that has been inconvenient at times.

I'm trying to remember if I've even been to a big concert since 2005 or 2006. I don't think I have. And I don't miss it. I might make an exception if RUSH comes around again, or I might not.

I switched in a credit union in 1991.

The ATM only gets used in an emergency, and only when the cost of the fee is about the same as fuel costs to make a special trip to the credit union to withdraw cash.

I haven't quite figured out a work-around for the fees tacked on to the phone bill. They have us bent over reach for the soap on that one.

Shipping & handling? Who pays that shit? Even my 300-pound bed didn't have S&H tacked on. (Built-in tho the base price? Yeah, sure, because in this world, nothing is really free.)

Bank of America’s new debit card fee, which also has been tested or implemented by other banks, joins a long and growing list of similar charges that consumers now encounter in the course of daily life. Among them: airline baggage fees, hotel Internet fees, “convenience charges” for concert and sporting tickets, ATM fees, bank teller fees, paper statement fees, fees hidden in phone and cable bills, taxicab fuel surcharges and exorbitant shipping and handling costs.

I haven't flown on a plane in probably eight years. And yes, that has been inconvenient at times.

I'm trying to remember if I've even been to a big concert since 2005 or 2006. I don't think I have. And I don't miss it. I might make an exception if RUSH comes around again, or I might not.

I switched in a credit union in 1991.

The ATM only gets used in an emergency, and only when the cost of the fee is about the same as fuel costs to make a special trip to the credit union to withdraw cash.

I haven't quite figured out a work-around for the fees tacked on to the phone bill. They have us bent over reach for the soap on that one.

Shipping & handling? Who pays that shit? Even my 300-pound bed didn't have S&H tacked on. (Built-in tho the base price? Yeah, sure, because in this world, nothing is really free.)

Labels:

Corporations,

Greed,

Haves vs. Have Nots

Monday, May 31, 2010

Monday Morning Musings

I'm not sure when I started obsessing about life and how quickly it seems to pass as I get older. It has definitely been a bigger blip on my radar since I turned 40.

When you are 20, you feel immortal and the world awaits you. Yet, if you can manage to make it through four consecutive average cat life cycles from that point, you are indeed lucky.

The unfortunate event on March 1st when I broke a number of bones in my face, the resulting surgery a bit more than 2 weeks later, and then my 50th birthday a month later, have all had an impact on how I view life. It seems so much more fragile now than it ever has before. The reality is that any of our seemingly stable lives can be turned upside down in the blink of an eye. Moreover, it is inevitable. The older we get, the greater the odds that we are on the cusp of a shattering event.

This understanding, which bears down upon me without my approval, is truly maddening sometimes. I see other people carrying on with their happy lives in what appears to be blissful ignorance of reality. I wish I could be like them. But are they all really unaware? Do they just have a more effective method of dealing with it and suppressing the associated emotions and anxiety?

We spend our lives gathering stuff: material possessions, friendships, and memories. We stuff our brains full of music, films, books, travels, sports scores, work experiences, Excel spreadsheet functions, HTML code, user IDs, passwords, credit card numbers, and expiration dates.

Our closets are packed with clothing and boxes in which stuff was delivered. Most people can't even use their garages because they are overflowing with possessions. And this is a relatively new phenomenon. My mother still remembers a time when she only had what was truly needed. She remembers her father telling the story of the first time he ever saw a motor car. He was so frightened he hid in a ditch. Running water and electricity inside the home were new luxuries, and still out of reach for many.

In that short span of time we have evolved into a people who have been born into such luxuries and take them for granted. We no longer need to hunt and gather for survival. Millions of us sit in a chair each day, tapping our fingers on plastic to manipulate data. And millions of us are paid well for it. But not in cash.

Someone else is tapping their fingers on plastic buttons to transfer "money" from one place to another place. When my place receives this transfer, I can then tap my fingers to move it from my place to the place which owns my house. Never having to lay eyes upon currency is a luxury.

I buy my food by swiping a piece of plastic through a chunk of plastic. That's how I get my groceries, my housewares, and fuel for my car so I can drive around and buy all this stuff. Quite amazing.

I don't even need to leave my house for a lot of the stuff I get. Tap tap tap on the plastic, select something you desire on a screen, type in a few numbers which gives instructions to computers to transfer a bunch of numbers from one place to another, and voila! A few days later, stuff comes to your door in a brown truck. And all of this is achieved by data passing through the air, or wires, at the speed of light.

Even in my lifetime, I remember how labor-intensive it was to gather information. I actually had to get up, get in the car, and drive to another building which housed thousands of books. I had to flip through drawers packed with thousands of little cards that contained directions to find the book which would contain the information I needed. And that was all well and good as long as someone else hadn't borrowed the book. There was even a human there to help you, if you needed it. Free of charge!

Now it is possible to gather data on a little chunk of plastic that you can carry with you, and tap on, or so I've read on this big piece of plastic I'm staring at as I tap these thoughts on my plastic buttons -- soon to be available for reading by anyone in the world fortunate enough to have a similar plastic device and viewing screen. You can even do this while you are driving around, buying shit you don't need, and swiping plastic to pay for it. Amazing!

What a world we live in, however briefly against the longer timeline of existence.

In this world of wonder and achievement, I am truly baffled that I can be so depressed. I don't just see the beauty and the wonder; I see everything. While this world in which we live would be unrecognizable to my grandparents in their youth, a few things haven't changed at all. Things like greed.

If we were truly immortal, or even if we could live 500 years, or 300 years, I could understand the concept of greed more easily than I can from my perspective of life at 50.

I am truly aghast that greed remains as pervasive and unevolved as it is. Greed is what compels us to do absurd things like drilling a mile deep -- underwater -- for fuel to power these moving boxes of steel we need in order to drive to a bigger, fixed-position box and punch plastic all day so that we can acquire a bunch of other (much smaller) numbers which get shifted around in the ether. After accruing enough of these numbers we call our own, we can drive around and buy stuff.

Greed is what allowed us to come here, take this land, and call it ours. Greed made us establish arbitrary and artificial boundaries, staking poles in the ground, adorned with absolutely meaningless pieces of patterned cloth in order to have what is essentially a meaningless and hollow identity.

Now that we have that, greed is driving us to destroy it. And we're no longer content to take advantage of people from outside our artificial boundaries with identifies different from our own; we seem eager to screw the life out of anything and everything we get our hands on in order to get more personal numbers stacked in our favor, whether it's our neighbors, the fields which grow the food to keep us alive, the water we need to quench our thirst, or the air we breathe.

We seem to have become completely uninterested in the numbers of our brothers and sisters who have had their equally short and fragile lives ended sooner than necessary by greed.

If nothing else, life is about adjusting and adapting to changes. Life is about caring and understanding. Life is about overcoming selfishness and greed. Life is about understanding that we are of the world and not vice-versa, and behaving accordingly. Failure to comprehend these simple facts is criminal. And we seem to be a nation and a world of criminals.

I have my own issues with comprehension. I cannot comprehend how, in this wondrous short time of bounty and achievement, so many of us cannot be content and enjoy our own personal experiences. Instead, we feel a necessity to exploit and control others, and often to focus on the most asinine of restrictions, while allowing all manner of other profligate atrocities to run rampant. I cannot comprehend how this path of greed we have chosen can be sustained much longer, nor can I comprehend how those of us who never ponder the ramifications of our enormous footprint will deal with the reality when it finally does deliver the ultimate smackdown.

On this day, arbitrarily set aside by some authority, in which we are asked to remember those who have fallen (some of whom still were not even allowed to be open and honest about who they were), and as I also include those who gave up a portion of their life, perhaps the best portion of it (and in many cases, a limb or two, if not their entire life), in their gift of service to this relatively recent nation of artificial boundaries conceived of, and awash in, greed, I have to ask myself if it was a truly necessary and noble cause, or simply a more short-sighted exploitation to fulfill a craven lust before casting them aside like spent fuel rods.

Sorry. I know I can come across as a major downer sometimes. But I think a lot. And I will honor our veterans today by saying we need to do everything in our power to stop creating so many of them for unjust causes. Those numbers (a trillion or two) piled up in someone's account which were used to fund the recent and ongoing wars could have been better transferred elsewhere in our relentless pursuit of stuff.

Live and let live, gently, and with responsible awareness and compassion.

When you are 20, you feel immortal and the world awaits you. Yet, if you can manage to make it through four consecutive average cat life cycles from that point, you are indeed lucky.

The unfortunate event on March 1st when I broke a number of bones in my face, the resulting surgery a bit more than 2 weeks later, and then my 50th birthday a month later, have all had an impact on how I view life. It seems so much more fragile now than it ever has before. The reality is that any of our seemingly stable lives can be turned upside down in the blink of an eye. Moreover, it is inevitable. The older we get, the greater the odds that we are on the cusp of a shattering event.

This understanding, which bears down upon me without my approval, is truly maddening sometimes. I see other people carrying on with their happy lives in what appears to be blissful ignorance of reality. I wish I could be like them. But are they all really unaware? Do they just have a more effective method of dealing with it and suppressing the associated emotions and anxiety?

We spend our lives gathering stuff: material possessions, friendships, and memories. We stuff our brains full of music, films, books, travels, sports scores, work experiences, Excel spreadsheet functions, HTML code, user IDs, passwords, credit card numbers, and expiration dates.

Our closets are packed with clothing and boxes in which stuff was delivered. Most people can't even use their garages because they are overflowing with possessions. And this is a relatively new phenomenon. My mother still remembers a time when she only had what was truly needed. She remembers her father telling the story of the first time he ever saw a motor car. He was so frightened he hid in a ditch. Running water and electricity inside the home were new luxuries, and still out of reach for many.

In that short span of time we have evolved into a people who have been born into such luxuries and take them for granted. We no longer need to hunt and gather for survival. Millions of us sit in a chair each day, tapping our fingers on plastic to manipulate data. And millions of us are paid well for it. But not in cash.

Someone else is tapping their fingers on plastic buttons to transfer "money" from one place to another place. When my place receives this transfer, I can then tap my fingers to move it from my place to the place which owns my house. Never having to lay eyes upon currency is a luxury.

I buy my food by swiping a piece of plastic through a chunk of plastic. That's how I get my groceries, my housewares, and fuel for my car so I can drive around and buy all this stuff. Quite amazing.

I don't even need to leave my house for a lot of the stuff I get. Tap tap tap on the plastic, select something you desire on a screen, type in a few numbers which gives instructions to computers to transfer a bunch of numbers from one place to another, and voila! A few days later, stuff comes to your door in a brown truck. And all of this is achieved by data passing through the air, or wires, at the speed of light.

Even in my lifetime, I remember how labor-intensive it was to gather information. I actually had to get up, get in the car, and drive to another building which housed thousands of books. I had to flip through drawers packed with thousands of little cards that contained directions to find the book which would contain the information I needed. And that was all well and good as long as someone else hadn't borrowed the book. There was even a human there to help you, if you needed it. Free of charge!

Now it is possible to gather data on a little chunk of plastic that you can carry with you, and tap on, or so I've read on this big piece of plastic I'm staring at as I tap these thoughts on my plastic buttons -- soon to be available for reading by anyone in the world fortunate enough to have a similar plastic device and viewing screen. You can even do this while you are driving around, buying shit you don't need, and swiping plastic to pay for it. Amazing!

What a world we live in, however briefly against the longer timeline of existence.

In this world of wonder and achievement, I am truly baffled that I can be so depressed. I don't just see the beauty and the wonder; I see everything. While this world in which we live would be unrecognizable to my grandparents in their youth, a few things haven't changed at all. Things like greed.

If we were truly immortal, or even if we could live 500 years, or 300 years, I could understand the concept of greed more easily than I can from my perspective of life at 50.

I am truly aghast that greed remains as pervasive and unevolved as it is. Greed is what compels us to do absurd things like drilling a mile deep -- underwater -- for fuel to power these moving boxes of steel we need in order to drive to a bigger, fixed-position box and punch plastic all day so that we can acquire a bunch of other (much smaller) numbers which get shifted around in the ether. After accruing enough of these numbers we call our own, we can drive around and buy stuff.

Greed is what allowed us to come here, take this land, and call it ours. Greed made us establish arbitrary and artificial boundaries, staking poles in the ground, adorned with absolutely meaningless pieces of patterned cloth in order to have what is essentially a meaningless and hollow identity.

Now that we have that, greed is driving us to destroy it. And we're no longer content to take advantage of people from outside our artificial boundaries with identifies different from our own; we seem eager to screw the life out of anything and everything we get our hands on in order to get more personal numbers stacked in our favor, whether it's our neighbors, the fields which grow the food to keep us alive, the water we need to quench our thirst, or the air we breathe.

We seem to have become completely uninterested in the numbers of our brothers and sisters who have had their equally short and fragile lives ended sooner than necessary by greed.

If nothing else, life is about adjusting and adapting to changes. Life is about caring and understanding. Life is about overcoming selfishness and greed. Life is about understanding that we are of the world and not vice-versa, and behaving accordingly. Failure to comprehend these simple facts is criminal. And we seem to be a nation and a world of criminals.

I have my own issues with comprehension. I cannot comprehend how, in this wondrous short time of bounty and achievement, so many of us cannot be content and enjoy our own personal experiences. Instead, we feel a necessity to exploit and control others, and often to focus on the most asinine of restrictions, while allowing all manner of other profligate atrocities to run rampant. I cannot comprehend how this path of greed we have chosen can be sustained much longer, nor can I comprehend how those of us who never ponder the ramifications of our enormous footprint will deal with the reality when it finally does deliver the ultimate smackdown.

On this day, arbitrarily set aside by some authority, in which we are asked to remember those who have fallen (some of whom still were not even allowed to be open and honest about who they were), and as I also include those who gave up a portion of their life, perhaps the best portion of it (and in many cases, a limb or two, if not their entire life), in their gift of service to this relatively recent nation of artificial boundaries conceived of, and awash in, greed, I have to ask myself if it was a truly necessary and noble cause, or simply a more short-sighted exploitation to fulfill a craven lust before casting them aside like spent fuel rods.

Sorry. I know I can come across as a major downer sometimes. But I think a lot. And I will honor our veterans today by saying we need to do everything in our power to stop creating so many of them for unjust causes. Those numbers (a trillion or two) piled up in someone's account which were used to fund the recent and ongoing wars could have been better transferred elsewhere in our relentless pursuit of stuff.

Live and let live, gently, and with responsible awareness and compassion.

Labels:

Cars,

Conservation,

Corruption,

Ecology,

Haves vs. Have Nots,

Holidays,

Injustice,

Malaise,

Technology,

War

Wednesday, April 21, 2010

The Next Wave

For months I've been hearing about this so-called "recovery" we're in and all the while I've believed this is a premature celebration. Of course, most of the celebrating has been on Wall Street, and a few upticks in department store sales. But nothing has really screamed recovery yet.

In fact, the devastation at the state level is beginning totrickle gush down to basic essential services -- our backbone. Atlanta's MARTA is feeling it.

Teachers are also about to become acutely aware that the recession is far from over.

The irony here is that we are making cutbacks in areas that cannot be outsourced to India or China.

While Wall Street banks may be celebrating, millions of people at the other end of the spectrum are bracing for yet another clusterfuck.

In fact, the devastation at the state level is beginning to

On Monday night, workers and officials at the Metropolitan Atlanta Rapid Transit Authority volunteered to paint the X’s on a third of the system’s buses and trains to symbolize the 30 percent cut in service the agency is facing because of a decline in sales tax revenue and a Republican-dominated Statehouse that has been slow to help.

[...]

“We are just crawling out of a recession,” said Sam Massell, a former mayor of Atlanta, “but we will be knocked back into another one if the salespersons are not behind the store counters, if the restaurant workers are not in the kitchens, if the office staff are not behind their desks.”

About 46 percent of the more than 100,000 people who use Marta to get to work each day say they do not have access to other forms of transportation.

More than 80 percent of the nation’s transit systems are considering or have recently enacted fare increases or service cuts, including those in Kansas City, Mo., Los Angeles, New York and Washington, D.C., according to a survey released this month by the American Public Transportation Association.

Teachers are also about to become acutely aware that the recession is far from over.

From coast to coast, public schools face the threat of tens of thousands of layoffs this year in a fiscal crunch likely to result in larger class sizes and fewer programs to help students in need.

Reports of deep staffing and service cuts are emerging in several states, including California, Illinois and New Jersey, as school officials say that finances have been stretched to the breaking point.

[...]

Education Secretary Arne Duncan estimated that education layoffs could total from 100,000 to 300,000 unless Congress acts.

"It is brutal out there, really scary," Duncan told reporters on Capitol Hill. "This is a real emergency. What we're trying to avert is an education catastrophe."

The irony here is that we are making cutbacks in areas that cannot be outsourced to India or China.

While Wall Street banks may be celebrating, millions of people at the other end of the spectrum are bracing for yet another clusterfuck.

Labels:

Economy,

Financial,

Haves vs. Have Nots,

US

Monday, March 22, 2010

Pelosi DID Have the Votes!

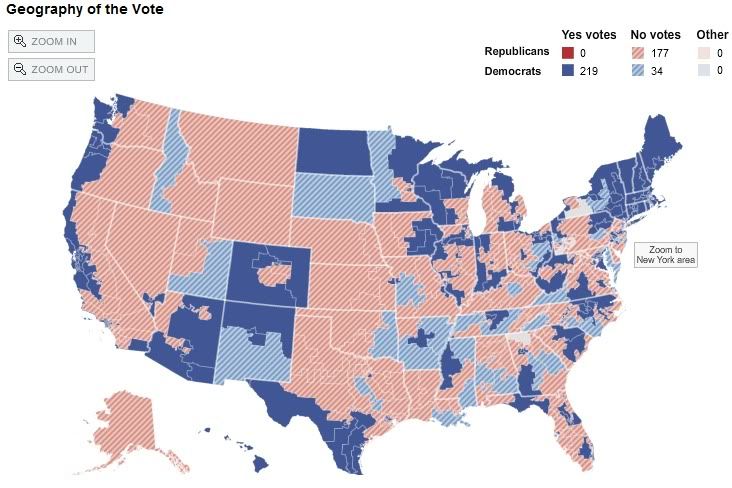

Finally, on Sunday, the House passed health care reform! The historic vote was 219-212.

It's very clear who the assholes are, and their constituents need to show them the exit.

Let's start with Boehner. I've been completely fed up and disgusted lately with him and his ilk spewing nonsense.

Sorry, dude. Do you mind if I call you dude? You got it all wrong. You represent a district in Ohio, not the nation as a whole, and whether or not your agenda truly reflects your constituents, or just your well-to-do, white right-wing Republican constituents, remains to be seen.

If you look at the map of voting patterns by members of the House, it would seem to me that a slim majority did indeed follow the wishes of their constituents: the left coast, New England, more lefty segments of the midwest, the independent progressive areas of the Southwest, and some impoverished areas of the Deep South where people most definitely should benefit from this reform measure.

So, in short, Rep. Boehner, with all due respect, blow your inaccurate statement right out your ass. And there are quite a few of your esteemed colleagues I'd like to see packing their shit up in boxes.

Bullshit. Enough of these tea-baggeresque inaccurate theatrics. Without a doubt, these selfish, hypocritical, reprehensible stink bombs who pass themselves off as leaders will continue their fight against fairness and compassion for millions of Americans who struggle daily against a corrupt system favoring huge profits for executives and shareholders at the expense of Americans in dire need.

I sincerely hope they pay a price at the polls someday.

The legislation is far from perfect, and frankly I am embarrassed that this is the best the United States of America can do right now, with the slimmest of margins. However, the alternative would have been unthinkable and far worse. At least now we have a door wedged open which will allow us, in the future, to improve upon what we now have, to reap the harvests of what's right about it, and to repair what is still broken, such as the outrageous hardships imposed on women who want or need an abortion.

Despite my embarrassment that this is the best we could do after such a long hard slog over the past year, I will still take it with pride that we are moving forward again.

It is a rare day when I can say this, but I am very proud of President Obama and especially Nancy Pelosi today. I am proud of the 219 Democrats (well, most of them. Stupak is still a jerk.) who voted to send this important legislation to the President's desk.

Feeling good about the direction of America is such a rare event, I feel as if I'm dreaming.

Lastly, I'd like to give a special shout-out to Representatives Mike Ross and particularly Marion "Good Riddance" Berry, both Arkansas Democrats. Rep. Berry was initially on this NYT map yesterday as a yes vote and somehow turned into a no vote. Given that Rep. Berry represents a huge swath of the poverty-ridden Mississippi Delta in eastern Arkansas, this is a shameful vote. "Good riddance" indeed. Both of those votes should have mirrored District 2 which you'll notice on the map in western Mississippi. Kudos to Bennie Thompson of that state for actually showing some guts and rational leadership. You made a Delta boy proud.

Marion Berry's pathetic spineless excuse? That the anti-abortion provisions of the bill don't go far enough. So, it's better to continue punishing children born into poverty without access to health care. Nice going, prick.

It's very clear who the assholes are, and their constituents need to show them the exit.

Let's start with Boehner. I've been completely fed up and disgusted lately with him and his ilk spewing nonsense.

The House Republican leader, Representative John A. Boehner of Ohio, said lawmakers were defying the wishes of their constituents. “The American people are angry,” Mr. Boehner said. “This body moves forward against their will. Shame on us.”

Sorry, dude. Do you mind if I call you dude? You got it all wrong. You represent a district in Ohio, not the nation as a whole, and whether or not your agenda truly reflects your constituents, or just your well-to-do, white right-wing Republican constituents, remains to be seen.

If you look at the map of voting patterns by members of the House, it would seem to me that a slim majority did indeed follow the wishes of their constituents: the left coast, New England, more lefty segments of the midwest, the independent progressive areas of the Southwest, and some impoverished areas of the Deep South where people most definitely should benefit from this reform measure.

So, in short, Rep. Boehner, with all due respect, blow your inaccurate statement right out your ass. And there are quite a few of your esteemed colleagues I'd like to see packing their shit up in boxes.

Representative Paul D. Ryan, Republican of Wisconsin, denounced the bill as “a fiscal Frankenstein.”

Representative Lincoln Diaz-Balart, Republican of Florida, called it “a decisive step in the weakening of the United States.”

Representative Virginia Foxx, Republican of North Carolina, said it was “one of the most offensive pieces of social engineering legislation in the history of the United States.”

Bullshit. Enough of these tea-baggeresque inaccurate theatrics. Without a doubt, these selfish, hypocritical, reprehensible stink bombs who pass themselves off as leaders will continue their fight against fairness and compassion for millions of Americans who struggle daily against a corrupt system favoring huge profits for executives and shareholders at the expense of Americans in dire need.

I sincerely hope they pay a price at the polls someday.

The legislation is far from perfect, and frankly I am embarrassed that this is the best the United States of America can do right now, with the slimmest of margins. However, the alternative would have been unthinkable and far worse. At least now we have a door wedged open which will allow us, in the future, to improve upon what we now have, to reap the harvests of what's right about it, and to repair what is still broken, such as the outrageous hardships imposed on women who want or need an abortion.

Despite my embarrassment that this is the best we could do after such a long hard slog over the past year, I will still take it with pride that we are moving forward again.

It is a rare day when I can say this, but I am very proud of President Obama and especially Nancy Pelosi today. I am proud of the 219 Democrats (well, most of them. Stupak is still a jerk.) who voted to send this important legislation to the President's desk.

Feeling good about the direction of America is such a rare event, I feel as if I'm dreaming.

Click the map to visit the New York Times Interactive Map of Votes.

Lastly, I'd like to give a special shout-out to Representatives Mike Ross and particularly Marion "Good Riddance" Berry, both Arkansas Democrats. Rep. Berry was initially on this NYT map yesterday as a yes vote and somehow turned into a no vote. Given that Rep. Berry represents a huge swath of the poverty-ridden Mississippi Delta in eastern Arkansas, this is a shameful vote. "Good riddance" indeed. Both of those votes should have mirrored District 2 which you'll notice on the map in western Mississippi. Kudos to Bennie Thompson of that state for actually showing some guts and rational leadership. You made a Delta boy proud.

Marion Berry's pathetic spineless excuse? That the anti-abortion provisions of the bill don't go far enough. So, it's better to continue punishing children born into poverty without access to health care. Nice going, prick.

Labels:

Bullshit,

Haves vs. Have Nots,

Health,

Politics

Tuesday, February 09, 2010

Feed Them to the Lions

One of the things that just upsets me so much about "Christians" these days, politically, is that I take so much abuse from them for being a pagan (feel free to substitute atheist since it's all the same to them), and yet I, and txrad, are doing good deeds, just as Jesus preached.

And I am annoyed as hell that we can't get a health care bill passed to cover those of us who are not as fortunate or lucky as others.

We get called all kinds of names, like "liberal" and "socialist" and "marxist" because we want a country, which we could easily have, but this is the measure which should be the standard.

So when the McCains and Palins and McConnells and Boehners start flapping their religious tea bags at me, pardon me if I need to leave the room. And to the Reids, and Pelosis, and Lincolns, and Landrieus, you are all just as shameful. You people have nothing to contribute. Because you don't fucking care for anyone except yourselves and your corporate contributions. Because you have no needs other than those.

It's a fucking shame.

And whom do you represent?

And I am annoyed as hell that we can't get a health care bill passed to cover those of us who are not as fortunate or lucky as others.

We get called all kinds of names, like "liberal" and "socialist" and "marxist" because we want a country, which we could easily have, but this is the measure which should be the standard.

So when the McCains and Palins and McConnells and Boehners start flapping their religious tea bags at me, pardon me if I need to leave the room. And to the Reids, and Pelosis, and Lincolns, and Landrieus, you are all just as shameful. You people have nothing to contribute. Because you don't fucking care for anyone except yourselves and your corporate contributions. Because you have no needs other than those.

It's a fucking shame.

And whom do you represent?

Labels:

Haves vs. Have Nots,

Health,

Politics

Sunday, October 11, 2009

Dear Pope

Why not give this a shot, eh? You and I agree on the death penalty. Prove to me that you are serious about troubling issues.

Labels:

Corruption,

Food,

Haves vs. Have Nots,

Humor,

Justice,

Politics

Wednesday, September 09, 2009

Banking on Dirty Tricks

Don't get me wrong; I'm not against banks having a fee system in place to discourage and punish those who willfully and routinely are guilty of overdrawing on their accounts. I do, however, think most such fees are grossly excessive given the automated nature of most banking transactions and the check processing system. A $29 insufficient funds fee is virtually all profit for the bank aside from the 50-cents for a computer-generated notice printed out and mailed to the customer in an envelope.

It is all too common for several such fees to be applied in one day if a customer paid some bills and the checks all hit at once. Obviously the customer does bear some financial management responsibility in avoiding this scenario, but it does happen, even to the best of us who do keep a close eye on our finances.

There is now a more troubling and grossly unfair practice emerging which involves debit cards and fees for spending more than you have in the account.

Wait a minute. Debit cards are like cash, right? How can you spend more cash than you have? It's not like buying something on credit, or exceeding your credit limit. Nonetheless, some banks are now allowing this to occur with debit cards, the customer isn't declined on the spot for the transaction, and are having fees applied to each transaction which far exceed the cost of the item being purchased in many situations.

This is clearly excessive, and extremely profitable for the banks, so of course they don't want to be more upfront than they are required to be. (Hint: we need regulation to keep consumers from getting screwed.) And they are also being quite deceptive and tricky to increase their monetary take from honest mistakes.

Ahh yes, of course. The banks are always looking after the little guys, helping us avoid "embarrassment." You know what? Screw that. I'm not sure what percentage of the population would rather get screwed out $238 or even $39 rather than have an embarrassing moment, but if it were me, I'd be content to leave a situation red-faced than have my pocket picked by a financial institution.

What a load of BS. They are doing nothing more than hijacking the fee which would have been collected by the merchant and thus boosting their own profits.

Yep, always looking out for the little guys.

This is simply insidious. It's spreading the wealth...from the bottom to the top.

It is all too common for several such fees to be applied in one day if a customer paid some bills and the checks all hit at once. Obviously the customer does bear some financial management responsibility in avoiding this scenario, but it does happen, even to the best of us who do keep a close eye on our finances.

There is now a more troubling and grossly unfair practice emerging which involves debit cards and fees for spending more than you have in the account.

Wait a minute. Debit cards are like cash, right? How can you spend more cash than you have? It's not like buying something on credit, or exceeding your credit limit. Nonetheless, some banks are now allowing this to occur with debit cards, the customer isn't declined on the spot for the transaction, and are having fees applied to each transaction which far exceed the cost of the item being purchased in many situations.

When Peter Means returned to graduate school after a career as a civil servant, he turned to a debit card to help him spend his money more carefully.

So he was stunned when his bank charged him seven $34 fees to cover seven purchases when there was not enough cash in his account, notifying him only afterward. He paid $4.14 for a coffee at Starbucks — and a $34 fee. He got the $6.50 student discount at the movie theater — but no discount on the $34 fee. He paid $6.76 at Lowe’s for screws — and yet another $34 fee. All told, he owed $238 in extra charges for just a day’s worth of activity.

This is clearly excessive, and extremely profitable for the banks, so of course they don't want to be more upfront than they are required to be. (Hint: we need regulation to keep consumers from getting screwed.) And they are also being quite deceptive and tricky to increase their monetary take from honest mistakes.

But because consumers use debit cards far more often than credit cards, a cascade of fees can be set off quickly, often for people who are least able to afford it. Some banks further increase their revenue by manipulating the order of a customer’s transactions in a way that causes more of them to incur overdraft fees.

[...]

Bankers say they are merely charging a fee for a convenience that protects consumers from embarrassment, like having a debit card rejected on a dinner date.

Ahh yes, of course. The banks are always looking after the little guys, helping us avoid "embarrassment." You know what? Screw that. I'm not sure what percentage of the population would rather get screwed out $238 or even $39 rather than have an embarrassing moment, but if it were me, I'd be content to leave a situation red-faced than have my pocket picked by a financial institution.

William H. Strunk, a banking consultant, devised a program in 1994 that would let banks and credit unions provide overdraft coverage for every customer — and charge consumers for each transgression.

“You are doing them a favor here,” said Mr. Strunk, adding that overdraft services saved consumers from paying merchant fees on bounced checks.

What a load of BS. They are doing nothing more than hijacking the fee which would have been collected by the merchant and thus boosting their own profits.

In all, $27 billion in fee income flows from covering overdrafts from debit card purchases, A.T.M. transactions, checks and automatic payments for bills like utilities...

[...]

Yet fees, and how they are generated, remain a mystery to many consumers. Because regulators do not treat overdraft charges as loans, banks do not have to disclose their annualized cost to consumers.

And often, the price is enormous. According to the F.D.I.C. study, a $27 overdraft fee that a customer repays in two weeks on a $20 debit purchase would incur an annual percentage rate of 3,520 percent. By contrast, penalty interest rates on credit cards generally run about 30 percent.

Yep, always looking out for the little guys.

Ralph Tornes, who lives in Florida, is pursuing a lawsuit against Bank of America for charging him nearly $500 in overdraft fees in 2008 after it rearranged his purchases from largest to smallest. In May 2008, for instance, Mr. Tornes had $195 in his account when he made two debit purchases for $8 and $13; the bank also processed a bill payment of $256.

He claims that Bank of America took his purchases out of chronological order and ran the biggest one through first. So instead of paying $35 for one overdraft fee, he was stuck with three, for a total of $105.

This is simply insidious. It's spreading the wealth...from the bottom to the top.

Labels:

Financial,

Haves vs. Have Nots

Saturday, August 15, 2009

Whole Fools Market

John Mackey, CEO of Austin-based Whole Foods Market created a stir back in 2007 when it was revealed that he had been posting to a Yahoo financial forum under a pseudonym, promoting the financial strengths of his stores during a takeover of rival Wild Oats. That was pretty stupid and it called into question his

John Mackey, CEO of Austin-based Whole Foods Market created a stir back in 2007 when it was revealed that he had been posting to a Yahoo financial forum under a pseudonym, promoting the financial strengths of his stores during a takeover of rival Wild Oats. That was pretty stupid and it called into question his Wackey Mackey had gone and done it again, this time under his real name in an opinion piece for the Wall Street Journal concerning health care reform.

It's not so much what he said that has me pissed off as it is the fact the he went out of his way to write an article about the direction he believes we need to go for health care reform. Had this piece been written by the CEO of Walgreens, Citigroup, or John Deere, I would not have cared in the least, nor would it have been the least bit surprising. If I had a Citigroup bank account or credit card, I would not be rushing out to close the account. I wouldn't cease shopping at Walgreens (although I shop there less than once a year on average anyway) and I wouldn't suddenly be trying to sell my John Deere to buy a Cub Cadet. (I have plenty of other reasons for the latter, however.)

John Mackey is the CEO of a supermarket chain which began here in Austin by appealing to the local back-to-nature hippies and others who sought organic and natural foods. Obviously this remains their targeted customer -- people who are likely to be quite left-of-center politically, and have quite a knowledge about the health consequences of processed foods and unhealthy ingredients. We tend to read labels and avoid those items which don't meet our own personal dietary standards and preferences. I say "we" because I have been a Whole Foods shopper, off and on, for over 12 years. In 2007, I worked directly across 6th Street from the flagship store and headquarters. Believe it or not, the store is a big tourist attraction.

For him to write an opinion piece of this nature is not unlike the remorse I'd feel after working hard to elect a member of the Green Party to Congress, only to have that person start voting in lock-step with Republicans. Wacky Mackey has apparently forgotten the proclivities of vast numbers of his clientele. In addition, I could argue he may have forgotten his own humble and struggling start in business.

In 1978, twenty-five-year-old college dropout John Mackey and Rene Lawson, his twenty-one year old girlfriend, borrowed $45,000 from family and friends to open a small natural foods store called SaferWay in Austin, Texas (the name being a spoof of Safeway). When the couple was evicted from their apartment for storing food products in it, they decided to live at the store. Because it was zoned for commercial use, there was no shower stall, so they bathed using a water hose attached to their dishwasher.

Two years later, John Mackey partnered with Craig Weller and Mark Skiles to merge SaferWay with their Clarksville Natural Grocery, resulting in the opening of the original Whole Foods Market on September 20, 1980. At 12,500 square feet (1,160 m2) and with a staff of 19, the store was quite large in comparison to the standard health food store of the time.

Less than a year later, on Memorial Day in 1981, the worst flood in 70 years devastated the city of Austin. Caught in the flood waters, the store’s inventory was wiped out and most of the equipment was damaged. The losses were approximately $400,000 and Whole Foods Market had no insurance. Customers and neighbors voluntarily joined the staff to repair and clean up the damage. Creditors, vendors and investors all assisted in helping the store recover, and it reopened 28 days after the flood.

Or perhaps he believes, as a result of that experience, that everyone else in the country with inadequate or no insurance can get the voluntary helping hand from friends and neighbors. Who knows. But based on one idea he promotes in his opinion piece, it sure sounds like that is his belief.

Finally, revise tax forms to make it easier for individuals to make a voluntary, tax-deductible donation to help the millions of people who have no insurance and aren't covered by Medicare, Medicaid or the State Children's Health Insurance Program.

So, that's like a voluntary taxation for providing health coverage. Can we do the same with our military budget? I would like to opt out on a few things there, buddy.

Hopefully a lot of CEOs just like him would be compassionate enough to exercise some stock options and maybe voluntarily donate $100,000 or more to a worthy cause. And yeah, these people who financially need no help would get yet another tax write-off while those struggling with every penny earned would be praying for compassion and hoping for the best.

Blow that out your ass, Mackey, along with your embedded advertisement to encourage more folks to shop for natural and organic products (where? Oh, Whole Foods of course!) and a blatant promotion of how great the benefits are to his workers.

At Whole Foods we allow our team members to vote on what benefits they most want the company to fund. Our Canadian and British employees express their benefit preferences very clearly—they want supplemental health-care dollars that they can control and spend themselves without permission from their governments. Why would they want such additional health-care benefit dollars if they already have an "intrinsic right to health care"? The answer is clear—no such right truly exists in either Canada or the U.K.—or in any other country.

Rather than increase government spending and control, we need to address the root causes of poor health. This begins with the realization that every American adult is responsible for his or her own health.

Unfortunately many of our health-care problems are self-inflicted: two-thirds of Americans are now overweight and one-third are obese. Most of the diseases that kill us and account for about 70% of all health-care spending—heart disease, cancer, stroke, diabetes and obesity—are mostly preventable through proper diet, exercise, not smoking, minimal alcohol consumption and other healthy lifestyle choices.

Recent scientific and medical evidence shows that a diet consisting of foods that are plant-based, nutrient dense and low-fat will help prevent and often reverse most degenerative diseases that kill us and are expensive to treat. We should be able to live largely disease-free lives until we are well into our 90s and even past 100 years of age.

Many of our health care problems are not self-inflicted. Ever heard of automobile accidents? Ever heard of pedestrians or cyclists being slammed by a vehicle? Ever seen a hospital bill for weeks of intensive care?

Eating healthy and natural foods is a great thing and I highly encourage it. After 18 years of a vegetarian diet, txrad and I really haven't had any significant illnesses during this time, other than an occasional allergy due to local pollen, and that was several years ago.

But in March of 2007, txrad did have an accident resulting in a concussion. He spent two days in a hospital for observation mainly. They did brain scans and x-rays, and determined that he also had some fractured ribs, but there was nothing they could really do. It required rest and weeks of recovery at home to heal.

He was unemployed at the time -- had been for over three months. And despite the fact that he was still covered by insurance (incidentally from the advertising agency directly across the street from Whole Foods in downtown Austin), he still has about $3,000 in unpaid medical bills which were not covered by his insurance. He is also still unemployed. He is nagged daily by calls from collections attempting to get their hands on the funds. And his previously decent credit rating has probably been reduced to nothing.

Nice system we have here. And thanks, Mackey, for being so understanding.

We are all responsible for our own lives and our own health. We should take that responsibility very seriously and use our freedom to make wise lifestyle choices that will protect our health.

Gee, maybe if we had made the "lifestyle choice" to take the money we spent at Whole Foods Market through the years and instead, invested it in an interest-bearing account -- all $10,661.28 -- txrad's bills would be paid and we'd still have a nice health cushion. How stupid of us to have not thought of that option. (Yes, I do have a screen shot of a Quicken report I just pulled to back up my figure.)

There is already a "Boycott Whole Foods Market" group on Facebook. At the time I'm writing this, it already has 7,702 members. I'm one of them. A lot of people are pissed off about this. And that should start to worry the stockholders if this impacts the chain's profits which have already been battered somewhat by the recession.

I am in the awkward position of saying I have no desire to shop at Whole Foods while simultaneously being a stockholder in the company. And I hope to someday have an opportunity to vote on replacing John Mackey with a new CEO, one who doesn't quote Margaret Thatcher as a prelude to a piece which basically puts him or her in direct opposition to so many of those who have supported the business through the years.

***

Blueberry also had a nice rant which is where I found the link to the WSJ piece.

Crossposted at B3

Labels:

Food,

Haves vs. Have Nots,

Health,

Shopping

Friday, August 07, 2009

Credit Checks Are Screwing the Downtrodden

This isn't a new practice; in fact I read about this last year and another article appears in today's New York Times regarding employers running credit checks on job applicants and then refusing to hire those who appear to have a history of "bad decision-making."

Yeah, like the millions of people who made the "bad decision" to take a job at a company which would at some point lay them off, or the "bad decision" to feed their families vs. pay the mortgage when the option is either/or. And many made the "bad decision" to seek medical help for a serious injury when they had no health insurance because they can't afford it, and are now facing bankruptcy due to the enormous costs of health treatment.

Are there also millions of Americans who have abused credit cards, shopped for things they don't need and can't afford, simply because credit was easy? Of course. But this practice is screening out far too many honest workers who have been impacted by the current recession and making their lives far more difficult.

But hey, people who might easily pass a credit check are just one less thing to worry about because we know they aren't going to steal, right?

Business executives say that they have an obligation to be diligent and to protect themselves from employees who may be unreliable, unwise or too susceptible to temptation to steal, and that credit checks are a help.

“If I see too many negative things coming up on a credit check, it’s one of those things that raises a flag with me,” said Anita Orozco, director of human resources at Sonneborn, a petrochemical company based in Mahwah, N.J. She added that while bad credit alone would not be a reason to deny someone a job, it might reveal poor judgment.

“If you see a history of bad decision-making, you don’t want that decision-making overflowing into your organization,” she said.

More than 40 percent of employers use credit checks at least sometimes, according to a 2004 survey by the Society for Human Resource Management, up from 25 percent in 1998. The share has almost certainly risen today, say career counselors.

Yeah, like the millions of people who made the "bad decision" to take a job at a company which would at some point lay them off, or the "bad decision" to feed their families vs. pay the mortgage when the option is either/or. And many made the "bad decision" to seek medical help for a serious injury when they had no health insurance because they can't afford it, and are now facing bankruptcy due to the enormous costs of health treatment.

Are there also millions of Americans who have abused credit cards, shopped for things they don't need and can't afford, simply because credit was easy? Of course. But this practice is screening out far too many honest workers who have been impacted by the current recession and making their lives far more difficult.

But hey, people who might easily pass a credit check are just one less thing to worry about because we know they aren't going to steal, right?

Labels:

Debt,

Economy,

Haves vs. Have Nots,

Inappropriate

Sunday, March 08, 2009

I Love This Woman!

Labels:

Cooking,

Haves vs. Have Nots,

Obama

Friday, January 09, 2009

Alabamarama

I really hate to bad-mouth any state on account of a significant number of idiots, bigots, racists, homophobes, what have you. It would be quite easy to bad-mouth all 50 states to one degree of another. But some do have a nastier reputation than others and unfortunately for Alabama, that state gets another demerit thanks to this selfish prick.

It's not as if the sheriff is underpaid; he is drawing a salary of $64,000.... in Decatur, Alabama. He's able to do quite well there I imagine.

The prisoners in the Morgan County jail here were always hungry. The sheriff, meanwhile, was getting a little richer. Alabama law allowed it: the chief lawman could go light on prisoners’ meals and pocket the leftover change.

And that is just what the sheriff, Greg Bartlett, did, to the tune of $212,000 over the last three years, despite a state food allowance of only $1.75 per prisoner per day.

It's not as if the sheriff is underpaid; he is drawing a salary of $64,000.... in Decatur, Alabama. He's able to do quite well there I imagine.

Labels:

Food,

Greed,

Haves vs. Have Nots,

Human Rights

Monday, December 22, 2008

Avoidable Hunger In Zimbabwe

Photo credit: Tsvangirayi Mukwazhi/Associated Press

This is a scene from Zimbabwe of children gathering corn that spilled from a truck.

In the dirt lanes of Chitungwiza, the Mugarwes, a family of firewood hawkers, bake a loaf of bread, their only meal, with 11 slices for the six of them. All devour two slices except the youngest, age 2. He gets just one.

And on the tiny farms here in the region of Mashonaland, once a breadbasket for all of southern Africa, destitute villagers pull the shells off wriggling crickets and beetles, then toss what is left in a hot pan. “If you get that, you have a meal,” said Standford Nhira, a spectrally thin farmer whose rib cage is etched on his chest and whose socks have collapsed around his sticklike ankles.

[...]

Still dominated after nearly three decades by their authoritarian president, Robert Mugabe, Zimbabweans are now enduring their seventh straight year of hunger. This largely man-made crisis, occasionally worsened by drought and erratic rains, has been brought on by catastrophic agricultural policies, sweeping economic collapse and a ruling party that has used farmland and food as weapons in its ruthless — and so far successful — quest to hang on to power.

A survey by the UN World Food Program reported a shocking 60% of people had consumed only one meal the previous day, up from 13 percent last year. Those who had eaten nothing the previous day accounts for 12% of the population.

All of this brought about by an asshole's quest for power. Mugabe must go.

Labels:

Africa,

Haves vs. Have Nots,

Tyranny

Friday, October 17, 2008

No Fries With That?

I despise eating contests. Frankly, I'd be ashamed to participate in one when so many people are going hungry. And I'm not talking about Ethiopia. I wonder how many homeless and hungry people this guy may have passed on his way to Denny's Beer Barrel Pub where he consumed a burger weighing in at 20 pounds.

After he finishes what might be a world-record bowel movement, he should donate that $400 to a local food bank.

When asked what possessed him to eat a burger that big, Sciullo said: "I wanted to see if I could."

[...]

For completing the challenge in the under-five-hour time limit, Sciullo won $400, three T-shirts, a certificate "and a burger hangover, as I call it," Liegey said.

After he finishes what might be a world-record bowel movement, he should donate that $400 to a local food bank.

Labels:

Bowels,

Food,

Gluttony,

Haves vs. Have Nots

Wednesday, September 24, 2008

Need I Say More?

Why yes, thanks for asking. Every American taxpayer needs to stare at this chart for a minimum of 30 seconds. It should cause outrage, even in the absence of an economic meltdown.

Why yes, thanks for asking. Every American taxpayer needs to stare at this chart for a minimum of 30 seconds. It should cause outrage, even in the absence of an economic meltdown.You would think chief executives would be willing to bite the same bullet the rest of us underlings do. But how could they survive and be happy with a $350,000 a year salary, or even an $800,000 a year salary. How could they even be motivated to get up and go to work for such a paltry salary?

But Wall Street, its lobbyists and trade groups are waging a feverish lobbying campaign to try to fight compensation curbs. Pay restrictions, they say, would sap incentives to hard work and innovation, and hurt the financial sector and the American economy.

“We support the bill, but we are opposed to provisions on executive pay,” said Scott Talbott, senior vice president for government affairs at the Financial Services Roundtable, a trade group. “It is not appropriate for government to be setting the salaries of executives.”

But it's appropriate for taxpayers, most of whom are pinching pennies, to bail them out so they can continue drawing outrageous salaries? The only word which comes to mind is bullshit.

Senator Christopher J. Dodd, chairman of the committee, said the “authors of this calamity” should not walk away enriched.

So true. But to help keep this in perspective, let's not forget that most of us consider Dodd one of the

“This was no act of God,” Mr. Dodd said. “This was not like Hurricane Hike — Ike, rather. It was created by a combustible combination of private greed and public regulatory neglect, and now we must confront the present crisis.”

[...]

Mr. Dodd, who has received more contributions from Fannie Mae and Freddie Mac’s political action committees and employees ($133,900 since 1989) than any other senator, didn’t mention lapses in Congressional oversight.

Between the corruption in Congress, and the greed driving the lobbyists, how in the hell can we trust anyone there to work out a bailout plan that will actually work the way it should?

It sounds like the $700 billion could become another bridge to nowhere. Or a bridge directly into the corporate boardrooms.

Labels:

Economy,

Excess,

Financial,

Haves vs. Have Nots

Monday, September 22, 2008

Golden Showers Parachutes

No man or woman on this planet is worth $45 million. Even if $45 million doesn't carry the same weight it did 20 years ago. It's just wrong.

I don't care if you are a member of Metallica or U2, or Tiger Woods, or Magic Johnson, a CEO of HP, the Dalai Lama, or least of all, a glorified politician. Jesus Christ would probably agree with me on this point. And in this case it's a fucking severance package, not a salary.

I don't care if you are a member of Metallica or U2, or Tiger Woods, or Magic Johnson, a CEO of HP, the Dalai Lama, or least of all, a glorified politician. Jesus Christ would probably agree with me on this point. And in this case it's a fucking severance package, not a salary.

Friday, August 15, 2008

Donald Trump Comes to Ed McMahon's Financial Rescue

Hey Donald. If you've got an extra $150,000 to spare, I could sure use it. And I don't have a fucking bitch wife spending all mine.

Labels:

Haves vs. Have Nots,

Humor

Tuesday, August 05, 2008

Let the Games Begin

I'm eagerly anticipating the Beijing Olympics for a completely abnormal reason. I'm more interested in the potential for unexpected events which could disrupt the planned ones and potentially prove embarrassing for a country which should never have been awarded the games in the first place.

Where to begin...

Acts of God

Acts of Assailants

Airborne Particulates

Human Rights Violations

And of course, the Propaganda Panda.

But wait; there's more. Let's throw in the entire Bush family just to really ratchet things up a notch.

Where to begin...

Acts of God

Acts of Assailants

Airborne Particulates

Human Rights Violations

And of course, the Propaganda Panda.

On the ever-sensitive subjective of political protests, visitors are warned in no uncertain terms that protests on any subject from politics, to the environment and animal rights will not be tolerated.

[...]

Then again, few other Olympic cities have such an overt approach to propaganda work. Red banners have sprouted all over the city in recent days exhorting citizens to show their enthusiasm - and their obedience to the Party line.

"I participate, I contribute and I enjoy," a banner at the entrance to one of the parks set aside for "protest pens" at the Games reads. "Welcome Olympic Games with joyfulness and construct a harmonious society," says the banner at the other entrance.

But wait; there's more. Let's throw in the entire Bush family just to really ratchet things up a notch.

Labels:

Bullshit,

China,

Haves vs. Have Nots,

Injustice,

Olympics

Saturday, July 26, 2008

God, I Love Texas

Before you think I'm drunk, or that I've flipped out and joined the Republican Party, let me assure you neither scenario is true. It's just that I've been doing some research.

Those of you who have followed this blog closely for the past year or so probably remember a post here and there about credit card debts which happen to be delinquent and have tarnished my once stellar credit rating. Since I am embarking upon another post on the subject, I want to review a few facts so nobody thinks I'm one of the people who ran out and bought too many shoes, or a Ferrari, and now refuses to face the music.

Prior to starting my own company in 2004, my credit was impeccable. Back in the 80s I did clearly live beyond my means which wasn't hard to do considering my means at the time were a string of unsteady cashier jobs in university bookstores, or whatever. By the time I "grew up" and got a job as a data entry clerk in 1991 at an advertising agency, I was probably swimming in $30,000 credit card debt. I wasn't behind on payments, but I was certainly struggling. I'm sure my mother was helping fill in any financial gaps which is why I was able to make minimum payments.

My data entry job in advertising quickly turned into a career after a few shorts months and soon I was making a $22,000 salary instead of $18,000, and not long after that, it climbed by another few thousand. It seemed to take forever but I eventually paid off that credit card debt.

For the sake of brevity, I'm leaving out a few details -- like the time I had nearly paid everything off and then fell off the wagon and started spending again. But with a higher salary it was easier to pay it off quicker.

I still cursed myself by buying things I didn't necessarily need. And even though I got the credit card spending under control, that didn't stop me from buying a BMW 330i in 2001, nor did it stop me from trading it in for a 2003 model because I didn't like the sound system in the 2001 model!

What's important here is that I accepted my problem, my taste for quality goods and services, and I paid my debts. They were my personal obligation.

Things were great in 2004 when I started my own agency after being approached by a client who wanted to do business with me. It was a busy year and I was happy I had finally done the ultimate. I utilized my experiences in the ad biz and went out solo. By 2005 I had paid off the car loan and my only credit card bills were being paid in full each month.

Unfortunately, this great big-spending client was starting to spend less and less. I had essentially taught them what they needed to know (or so they thought) for them to begin easing the purchase of television advertising time into their own business, thus cutting me out of the picture.

They were not my only client, but they were the only one that made the venture remotely profitable. And I use the term profitable very loosely. It paid a meager salary for myself and txrad which combined was probably not much above the average household income in Austin.