I have been standing on my soapbox frequently in the last several weeks and a simple search of the word economy will display some recent ones. It was only a week ago that I posted about the dismal economic situation in California, and this morning I read similar news coming from Pennsylvania.

Within two years, the Pennsylvania Turnpike Authority wants to convert a 311-mile stretch of I-80 into a toll road.

The new tolls, a particularly controversial part of Pennsylvania’s plans to meet its growing transportation needs, are an unpopular idea among users of I-80, long a free alternative to the Pennsylvania Turnpike for truckers, tourists and residents alike. But with Pennsylvania’s budgets stretched, like those of many other states, the legislature approved the proposal last July.

The tolls — which still face hurdles, notably a need for approval from the federal government — would provide a substantial share of the hundreds of millions of dollars a year that the state says it needs to repair and expand its roads and bridges and so keep up with traffic growth.

“The wish list is extensive,” said Chuck Ardo, a spokesman for Gov. Edward G. Rendell. “We have the highest number of structurally deficient bridges in the country, miles and miles of highway that need repair and public transit systems that need support.”

The transportation squeeze is hardly unique to Pennsylvania.

Indeed it is not. Even here in Texas, toll roads are being built around Austin and moves are afoot to convert some existing freeways into revenue generators. This amounts to a tremendous burden for drivers -- particularly those with longer commutes to jobs. Without a doubt, we are facing higher gasoline prices in the future and coupled with the fees to drive on the fastest routes from point A to point B, this will take a chunk out of the average paycheck. Read on, it gets

“There is a perfect storm,” said Phineas Baxandall, an analyst at the United States Public Interest Research Group. “States have had a hard time facing up to their shortfalls in their transportation programs, gas taxes haven’t kept up with inflation, and there’s all these bridges and roads that haven’t been maintained.”

The push to charge tolls along I-80 followed legislators’ rejection of Mr. Rendell’s proposal to lease the Pennsylvania Turnpike to private investors, an approach taken in Illinois, Indiana and Virginia. Lawmakers were wary that the investors might raise tolls too quickly.

[...]

As in other states, Pennsylvania lawmakers have been reluctant to raise their gasoline tax, the fourth-highest in the country, because fuel prices are so high. The tax would need to rise by 13 cents a gallon to meet the state’s transportation needs, the turnpike commission estimates. (In neighboring New Jersey, where the gas tax is the third-lowest in the country, Gov. Jon S. Corzine introduced a proposal last week to raise tolls on the New Jersey Turnpike, the Garden State Parkway and the Atlantic City Expressway as much as 700 percent by 2022.)

Under Pennsylvania’s plan, drivers on I-80 would pay the same as on the turnpike. Cars crossing the entire state would be charged $25, trucks $93.

I'm not sure what the ideal solution is to this critical situation but I'm not a supporter of tolls. It is obviously not just the interstate highway system needing maintenance but many secondary roads as well. And with such hefty tolls in place on the main thoroughfares, thousands of drivers will flood those secondary roads in order to avoid tolls, thus increasing wear and tear --and traffic -- on those roads, not to mention the obvious fact that fuel economy will also suffer under that scenario.

I believe the 13-cent per gallon tax increase to deal with the transportation needs would make far more sense as this would eliminate the search by drivers for toll-alternate routes. Granted, a gas tax hurts middle and lower income drivers the most, but the concept of an expressway for the privileged while the under-class is relegated to a second-class highway is repugnant.

In addition, higher gasoline prices absolutely will result in more conservation. As prices reach $4 or $5 a gallon, people will begin to think more about their driving habits and many unnecessary trips will be eliminated. And many of those who can will switch to more fuel-efficient vehicles or public transportation which definitely needs more funding for expansion.

The state wants to spend $2.1 billion in toll revenue over 10 years to improve I-80. Contrary to the claims of some critics, none of that money could be used to pay for mass transit in Philadelphia and other cities.

And lastly, the very idea of leasing the toll roads to private investors to manage is infuriating to me. Unfortunately, as with the trend in selling the lottery, I expect to see an increase in efforts to sell our toll roads to private entities as well. And that, my friends, is the only incentive I need to not buy a lottery ticket and refuse to travel on roads with tolls.

While the focus of this post thus far has been the states' problems with funding highway improvements, that is by no means the sole problem. I predict we are only seeing the tip of the iceberg. And this problem is not going to be solved in 2008, or 2009.

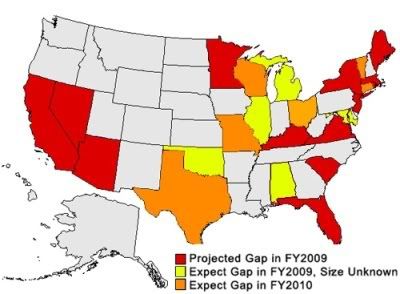

Click that picture if you want to read some sobering projections. During the next two years, half our states will be facing some severe budget shortfalls. More importantly, notice the states which are affected. They represent some of the highest concentrations of our overall population. And interestingly, Pennsylvania, the state which is unable to meet current transportation needs, isn't even listed as one of the states facing an overall budget gap. That's enough to make me wonder what might be going on internally with the other 50% of the states, whether it's in the area of health care, housing, employment, or road improvement funding. I doubt there are very many rosy scenarios and I see a lot of personal sacrifice on the horizon.

On a personal note, when txrad and I moved to Austin from Los Angeles ten years ago, I specifically wanted a house reasonably close to our place of employment, and that was back in 1997 when our world was quite different from the one we face today. We settled on the one in which we currently live. It was 10 miles from our office which doesn't sound close to some of you, but it was much better than the 23-mile commute each way in Los Angeles traffic, and with our Austin home and office being outside the city limits, we had a quick and easy trip in a rural environment.

Even with my recent job requiring me to travel downtown, that was still less than 13 miles each way. Despite having to deal with the much heavier traffic, I had to count my blessings that I wasn't one of the people who faced a commute of 25-30 miles, or more. Such commutes are obviously going to become more nightmarish in the near future thanks to a combination of toll roads, gasoline prices, and increased traffic. And I have no guarantees that my next best job offer won't be in the burgeoning northern area of metro Austin such as Round Rock or Georgetown, which happens to be 40 miles from my current residence.

As I stand at yet another crossroads in my life, I feel a certain paralysis in trying to determine the right steps to take to improve my own quality of life in the next few years -- a time in which it is likely to decrease for most. One luxury of my chosen profession is that it is an ideal work-at-home job, assuming the employers are open to it, and many are in my industry. I've done it for 7 of the past 8 years. It gives me the freedom to choose where I live and therefore have far greater control over my standard of living.

The idea of purchasing an inexpensive house on a lot large enough to maintain a large garden plot has much allure for me. By staying flexible in where I am willing to live, I am in a position where I could pay cash for such a house and therefore be rid of our current $1,300 monthly mortgage and $4,500 annual property tax. For many people, that is a dream for the retirement years, at best. The sale of this house, which has a significant amount of equity, could then be invested either for retirement or to provide supplemental income.

On the flip side, barring a full-blown economic depression (which I wouldn't say is completely insane to believe), this house is far more likely to increase in value than proposed El Cheapo Casa. And when up against a wall, there are at least more possibilities for out-of-home employment if and when that is necessary. Whether it pays enough to cover the higher cost of living here remains to be seen. At least with El Cheapo Casa, we would have a roof over our heads, and could put food in our mouths from a couple of minimum wage gigs.

Yes, this is what consumes my thoughts these days, and with each additional indicator of tough economic times ahead, I feel I am on the right track in analyzing my options. However, actually making a decision is extremely difficult. Being in the enviable position of having options is quite often a curse.

I have no idea who coined the term "Life's a bitch and then you die" but I am quite sure they were not a member of the well-heeled who purchase vacation homes in Jackson Hole with the same forethought some of us devote to purchasing a 10-pound bag of potatoes.

Crossposted at Big Brass Blog

No comments:

Post a Comment